How to Find Adventure-Ready Savings Accounts in Australia

Understanding Your Financial Needs

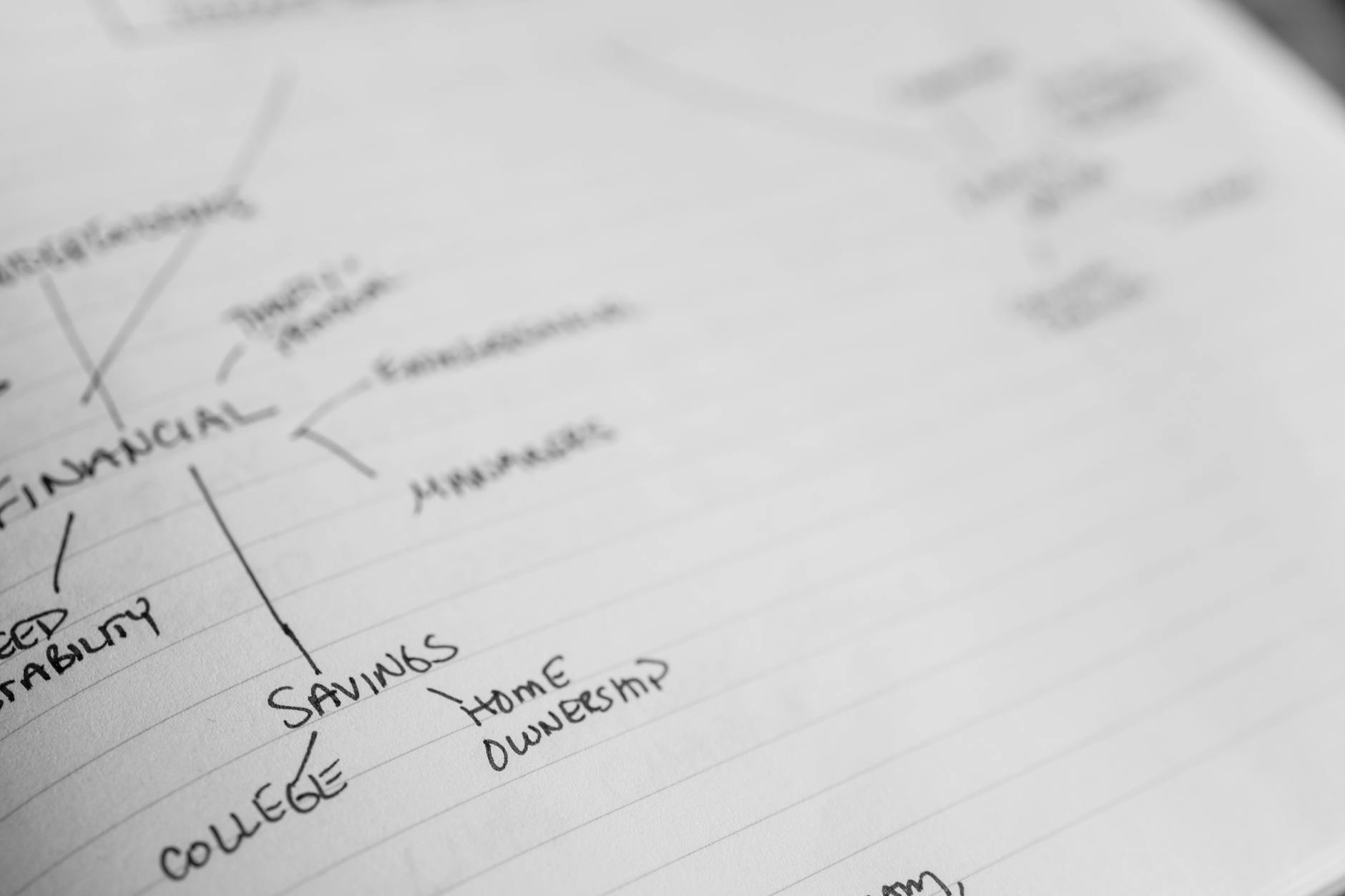

Recognising your financial needs is like mapping out your next big outdoor adventure. Just as we plan our treks along the scenic Mount Coot-tha trails, identifying the best account options requires careful analysis of our earnings and expenditures. This includes understanding how our income flows and changes over time, particularly for those of us whose income might vary due to the nature of our work. When considering how to open bank account options, think of it as gearing up for a trek; you'll want the right gear to keep you agile and prepared for sudden shifts in terrain, just as the right account can adapt to fluctuating financial seasons.

Your savings goals should echo your adventurous spirit. Whether you're setting sights on a global journey or a more local excursion, embody that clarity in your financial planning. This involves evaluating what you want from your savings - perhaps a bonus saver account might align with your goals, offering the perks you need to make your journey smoother.

Additionally, lifestyle expenses mirror the spontaneous thrills of kayaking the vibrant Brisbane River. Just as we factor in equipment and travel permits into our plans, it's crucial to account for expenses that fuel your lifestyle in financial planning. Finding an account that can manage everyday expenses while also supporting long-term adventures, such as a joint bank account with flexible terms, could be your financial kayak, navigating both calm and rough waters. Each financial step should empower rather than restrain our adventurous spirits.

Features of Ideal Savings Accounts

High-Interest Options

When seeking the perfect savings account, one key feature is securing a high interest savings account. This is crucial for growing your funds, helping you stash away those crucial dollars needed for your next adventure-weekend rock climbing at Kangaroo Point cliffs, or kayaking along the Brisbane River. Many Australian banks offer enticing deals, so focus your search on those that promote high-interest yield rates, and take the time to compare bank accounts thoroughly.

Flexible Access and Withdrawals

Another important aspect is flexibility in accessing your funds. Look for accounts that allow easy withdrawals without penalties, ensuring you can tap into savings when that spontaneous trip calls. This flexibility is particularly valuable for those who face seasonal income patterns, like outdoor adventure guides. A high yield savings account Australia may not lock your funds, letting you enjoy the best of both worlds: growth and accessibility.

Bonus Offers and Rewards

Lastly, examine any bonus offers or rewards attached to savings accounts. Banks sometimes offer introductory interest rates or seasonal bonuses that can significantly boost your savings in short bursts. Ally your strategy with accounts offering these benefits, ensuring you align your choices with the adventure-hungry lifestyle you enjoy, from exploring Mount Coot-tha trails to kayaking down Brisbane’s stunning riverways.

Choosing the right savings account with these features can offer financial support tailored to an explorer’s life, enhancing your financial freedom and trip planning.

Top Search Strategies

When it comes to scouting for optimal savings accounts in Australia, utilizing comparison websites can be an excellent starting point. These platforms allow you to sift through various options, highlighting essential factors like interest rates and terms. For someone deeply invested in outdoor activities like kayaking on the Brisbane River, finding a high interest term deposit can offer greater returns on your savings, enabling you to fund new explorations or gear upgrades.

Diving into travel finance blogs is another avenue that offers rich insights tailored to adventurers. These blogs often carry testimonials and real-life examples of financial setups that work well for those of us passionate about exploring nature. Sharing stories from people who manage their finances with a flexible joint savings account, for instance, can provide actionable advice for making your financial plans as versatile as your next climbing adventure at the Kangaroo Point cliffs.

Lastly, online forums serve as vibrant communities where like-minded adventurers exchange tips and experiences. These platforms are teeming with practical advice and firsthand accounts on managing finances while planning trips, such as a trek through the lush Mount Coot-tha trails. Engaging with peers on these forums not only expands your financial literacy but also reinforces your eagerness to explore new horizons.

Adapting to Seasonal Income

Building a Savings Buffer

As an outdoor adventure enthusiast, the seasonal nature of our income requires us to be savvy about financial planning. Apart from saving for a travel adventure or converting a van, creating a savings buffer can be crucial. Establishing a high yield savings account is a significant first step. With such an account, you can accrue interest over time, providing a financial cushion during off-peak months. Think of it as a safety net that supports us while exploring the thrilling Mount Coot-tha trails.

Aligning with Cash Flow

For those with variable income, it's vital to align savings strategies with cash flow. Consider complementing your savings account with transaction accounts that facilitate easy access during lean periods. This can help you manage your finances without sacrificing the spontaneity we love in our adventures. Balancing between savings and readily available funds ensures we're prepared both for planned trips and life’s unexpected adventures.

Tracking Income Variability

Being aware of our seasonal cash inflows is essential. Create a record of income patterns, pinpointing high and low periods. This insight allows you to adjust contributions into your savings and transaction accounts, maximising efficiency. Remember, financial planning is like preparing for a hike: the better equipped you are, the more enjoyable the journey.

Avoiding Common Savings Account Pitfalls

Overlooking Account Terms

Adventure-seekers, we must avoid the trap of glossing over the fine print of savings accounts. Pay attention to terms like minimum balance requirements and harsh withdrawal penalties. Exploring these details is as essential as checking the weather before hitting the Mount Coot-tha trails. Just as a surprise storm can dampen your hike, an unexpected account restriction could severely impact your savings experience.

Ignoring Fees and Charges

Another rookie mistake on our financial wilderness journey is ignoring fees. Not unlike the hidden currents in the Brisbane River while kayaking, these overlooked charges can swallow your hard-earned savings without warning. From monthly account fees to transaction costs, it’s vital to navigate through these financial obstacles by thoroughly understanding what each account entails.

Neglecting Long-Term Benefits

In the same way that a view from the Kangaroo Point cliffs makes the climb worth the effort, the long-term benefits of a savings account should justify your choice. Interest rates and flexible withdrawals matter, but don't forget to assess the longevity of your pick. Seek out an account offering robust, long-term benefits to match your savings account options, balancing immediate rewards with future advantages for the ultimate financial trek.

Avoiding these common pitfalls will set you on the right path to financial success. Keep these lessons front of mind and ensure your savings account cooperatively supports your next adventure through Australia’s great outdoors.